Bookkeeping

Understanding Liquidity Ratios: Types and Their Importance

This takes an even closer look at the liquidity situation, as only the most liquid funds are compared to the current liabilities. These are the liquid funds that are available to the company very quickly, which is an advantage if an unexpected higher sum has to be paid at short notice. Liquidity ratios provide information about the liquid situation and stability of a company. We show you here which different ratios there are, how to calculate them and what the ideal values are. Striking an optimal balance between liquidity and solvency is vital for a brokerage’s stability.

What do Current Liabilities include in Liquidity Ratios?

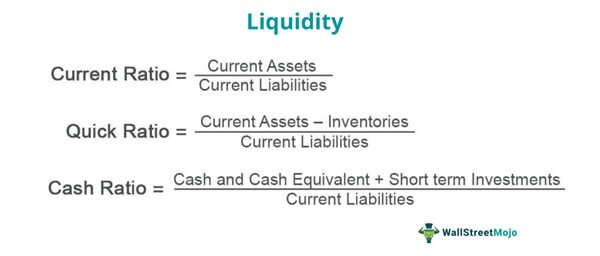

A higher liquidity ratio indicates a company is better equipped to pay off debts in the short term without needing to liquidate key operating assets or raise external funding. The Current Ratio is one of the most commonly used Liquidity Ratios and measures the company’s ability to meet its short-term debt obligations. It is calculated by dividing total current assets by total current liabilities. Also known as the ‘acid-test’ ratio, the quick ratio measures a company’s capacity to pay current liabilities without needing to sell inventory or get additional financing.

Liquidity ratio formula

It focuses on the company’s ability to meet its current obligations, which are usually short-term in nature. The current ratio measures a company’s capacity to pay off all its short-term obligations. Solvency, on the other hand, is a firm’s ability to pay long-term obligations. For a firm, this will often include being able to repay interest and principal on debts (such as bonds) or long-term leases.

Comparing Liquidity Ratios

A high current ratio means that a company has enough liquid assets to cover its immediate needs. A low current ratio indicates that a company may have difficulty paying its upcoming bills and seek additional financing to continue operations. They provide insight into a company’s ability to repay its debts and other liabilities out of its liquid assets. In addition, comparing liquidity ratios between companies is problematic.

Brokerages need to carefully manage their leverage, borrowing sources, and asset-liability profile to maintain both solvency and liquidity. Having sufficient high-quality liquid assets as a percentage of net outflows provides a liquidity buffer. Conservative financial leverage, diversified funding sources, and adequate capital cushions safeguard solvency. In the stock market, brokerage firms act as intermediaries facilitating trading and lending of securities on behalf of clients. One of their key risks is liquidity risk – the risk of not having enough liquidity to fulfill client orders or borrowing demands.

What is the Receivables Turnover?

- Liquidity Ratios measure a company’s ability to meet its short-term financial obligations.

- However, if liquidity is interpreted more narrowly and the quick ratio is considered, the ratio is lower, but in the example it is still sufficient at 213%.

- It compares a company’s total debt to its total assets to show how leveraged it is.

- As a useful financial metric, the liquidity ratio helps to understand the financial position of a company.

- Current assets like cash, marketable securities, accounts receivable, and inventory are considered liquid assets.

The Basic Defense Ratio computes the number of days a company counterbalances money expenses without the help of supplementary financing from other fount. The higher the ratio, the longer the company can survive without income, external financing, or long-term assets. The uptick or reduction in the SLR directly impacts the availability of loanable funds in the economy. A higher SLR sucks out liquidity from the system as it forces banks to maintain a larger cash reserve.

This demonstrates how the current and quick ratios of this hypothetical company indicate good short-term liquidity. However, the low cash ratio highlights how it may run into trouble covering liabilities with only its cash on hand. Analysing all three ratios together paints a more complete picture of liquidity. However, liquidity ratios should also be compared to industry peers and trends over time to get a better gauge of appropriate levels. The optimal current, quick, and cash ratios vary across different industries.

A Liquidity Ratio that is consistently below 1.0 may also be an indication of financial distress and could lead to bankruptcy or insolvency in the near future. Let’s dive deeper into the different kinds of Liquidity Ratios and their corresponding formulas. how to adjust an entry for unearned revenue chron com Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. With that said, from a liquidity standpoint, a negative NWC is preferred over a positive NWC.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. If the Current Ratio is greater than 1.0, then Net Working Capital will be positive since Current Assets will be greater than Current Liabilities.

Liquidity ratios measure whether a company has sufficient liquid assets to cover its short-term liabilities and near-term obligations. For brokerages, liquidity is crucial to meet client cash withdrawals, trading settlement dues, and margin calls in a timely manner during periods of market volatility. Liquidity ratios are important because they provide crucial insights into a company’s financial health and flexibility by measuring its ability to meet near-term obligations.