Bookkeeping

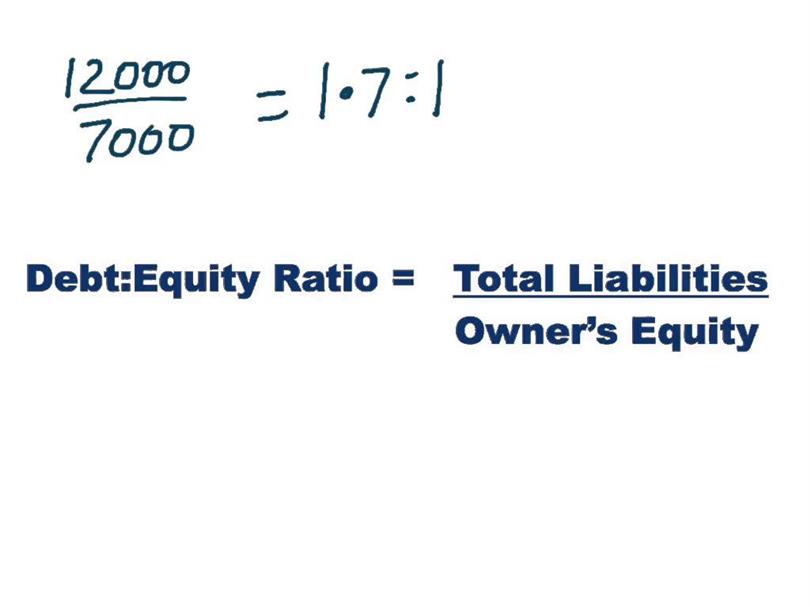

Debt-to-equity Ratio Formula and Calculation

To look at a simple example of a debt to equity formula, consider a company with total liabilities worth $100 million dollars and equity worth $85 million. Divide $100 million by $85 million and you’ll see that the company’s debt-to-equity ratio would be about 1.18. A low debt to equity ratio means a company is in a better position to meet its current financial obligations, even in the event of a decline in business.

What Is a Good Debt-to-Equity Ratio?

It is crucial to consider the industry norms and the company’s financial strategy when assessing whether or not a D/E ratio is good. Additionally, the ratio should be analyzed with other financial metrics and qualitative factors to get a comprehensive view of the company’s financial health. The concept of a “good” D/E ratio is subjective and can vary significantly from one industry to another.

Is a Higher or Lower Debt-to-Equity Ratio Better?

- 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

- For instance, if Company A has $50,000 in cash and $70,000 in short-term debt, which means that the company is not well placed to settle its debts.

- It is possible that the debt-to-equity ratio may be considered too low, as well, which is an indicator that a company is relying too heavily on its own equity to fund operations.

- To accurately assess these liabilities, companies often create a debt schedule that categorizes liabilities into specific components.

At its simplest, the debt-to-equity ratio is a quick way to assess a company’s total liabilities vs. total shareholder equity, to gauge the company’s reliance on debt. Each industry has different debt to equity ratio benchmarks, as some industries tend to use more debt financing than others. A debt ratio of .5 means that there are half as many liabilities than there is equity. In other words, the assets of the company are funded 2-to-1 by investors to creditors. This means that investors own 66.6 cents of every dollar of company assets while creditors only own 33.3 cents on the dollar. The debt to equity ratio is calculated by dividing total liabilities by total equity.

Optimal Capital Structure

To get a clearer picture and facilitate comparisons, analysts and investors will often modify the D/E ratio. They also assess the D/E ratio in the context of short-term depreciation and amortization on the income statement leverage ratios, profitability, and growth expectations. But investors judge leverage ratios differently, depending on the industry sector your company’s in.

However, if the company were to use debt financing, it could take out a loan for $1,000 at an interest rate of 5%. A low D/E ratio shows a lower amount of financing by debt from lenders compared to the funding by equity from shareholders. The debt-to-equity ratio belongs to a family of ratios that investors can use to help them evaluate companies. A company’s ability to cover its long-term obligations is more uncertain, and is subject to a variety of factors including interest rates (more on that below). Gearing ratios focus more heavily on the concept of leverage than other ratios used in accounting or investment analysis. The underlying principle generally assumes that some leverage is good, but that too much places an organization at risk.

For example, Company A has quick assets of $20,000 and current liabilities of $18,000. Quick assets are those most liquid current assets that can quickly be converted into cash. These assets include cash and cash equivalents, marketable securities, and net accounts receivable. Utilities and financial services typically have the highest D/E ratios, while service industries have the lowest. On the other hand, when a company sells equity, it gives up a portion of its ownership stake in the business. The investor will then participate in the company’s profits (or losses) and will expect to receive a return on their investment for as long as they hold the stock.

Unlike the debt-assets ratio which uses total assets as a denominator, the D/E Ratio uses total equity. This ratio highlights how a company’s capital structure is tilted either toward debt or equity financing. The debt-to-equity (D/E) ratio is used to evaluate a company’s financial leverage and is calculated by dividing a company’s total liabilities by its shareholder equity. It is a measure of the degree to which a company is financing its operations with debt rather than its own resources. This looks at the total liabilities of a company in comparison to its total assets. On the surface, this may sound like the debt ratio formula is the same as the debt-to-equity ratio formula.

And a high debt-to-equity ratio can limit a company’s access to borrowing, which could limit its ability to grow. Using excel or another spreadsheet to calculate the D/E is relatively straightforward. First, using the company balance sheet, pull the total debt amount and the total shareholder equity amount, and enter these numbers into adjacent cells (e.g. E2 and E3).

The debt-to-equity ratio is another important tool in corporate finance assessment. It demonstrates a company’s financial leverage by using basic information from its balance sheet. This financial ratio reveals how much of a business’s operations is funded by debt and how much by entirely company-owned money. Debt-to-equity is a gearing ratio comparing a company’s liabilities to its shareholder equity.

The simple formula for calculating debt to equity ratio is to divide a company’s total liabilities by its total equity. Including preferred stock in total debt will increase the D/E ratio and make a company look riskier. Including preferred stock in the equity portion of the D/E ratio will increase the denominator and lower the ratio. This is a particularly thorny issue in analyzing industries notably reliant on preferred stock financing, such as real estate investment trusts (REITs). As a highly regulated industry making large investments typically at a stable rate of return and generating a steady income stream, utilities borrow heavily and relatively cheaply. High leverage ratios in slow-growth industries with stable income represent an efficient use of capital.