Bookkeeping

Debits and Credits in Accounting: With Journal Entry Examples

Halfway through the year, she decides to order a further 30 at $15, then another 20 lipsticks, at $20 each, at the end of the year. Lisa’s stock now consists of 90 lipsticks, and by the end of the period, she sells 15 of them. If Robert uses LIFO to determine the cost of his inventory, the first necklace sold will be priced at $30, even if it came from the previously ordered stock. The first 50 necklaces sold would be assigned the cost of $30, while the following 100 necklaces sold would be priced at $25. For example, if Robert runs a jewelry shop and uses the LIFO costing method to manage his inventory, and he buys 100 silver necklaces at $25 per necklace.

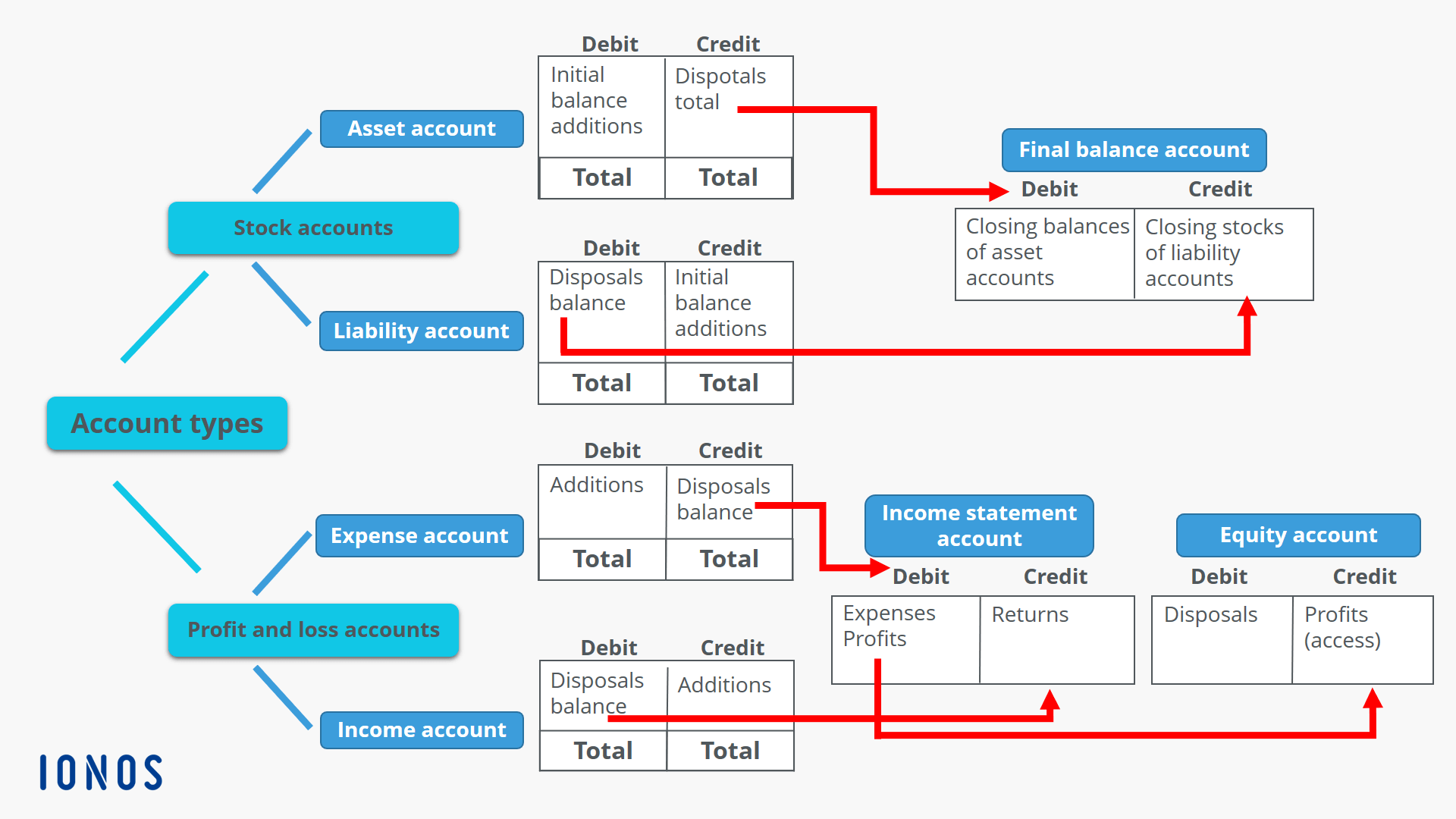

A Transaction Overview

- A perpetual inventory system keeps continual track of your inventory balances.

- Accounting and inventory, while both critical components of any business, may seem like two separate tasks, but they are very much linked.

- The inventory system used by a business must be able to track multiple transactions as goods are received, stored, transformed into finished goods, and eventually sold to customers.

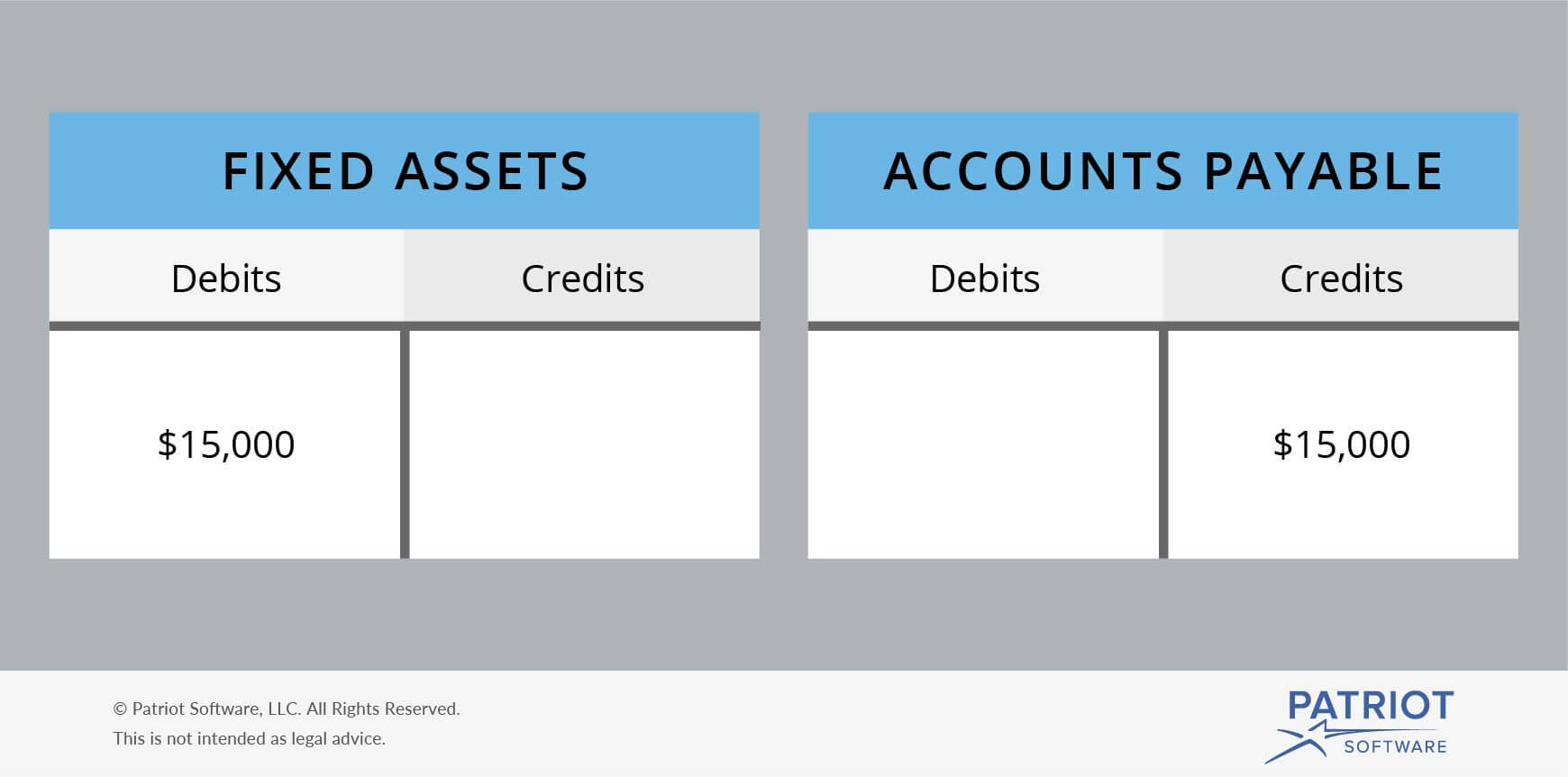

- The company receives inventory (asset increases) but also incurs a liability (accounts payable).

- The total amount of debits must equal the total amount of credits in a transaction.

For instance, when a company purchases equipment, it debits (increases) the equipment account, which is an asset account. Debits and credits aren’t just about tracking expenses or revenue—they are the foundation of how every financial transaction affects your company’s overall financial health. The account Inventory Change is an income statement account that when combined with the amount in the Purchases account will result in the cost of goods sold.

Related AccountingTools Courses

Every business has some form of inventory, whether it’s raw materials, finished products, or work-in-progress items. The LIFO method, or last-in, first-out technique, asserts that the last stock added to inventory will be the first sold. At the end of an accounting period, the inventory leftover would be the oldest of the purchased goods. The FIFO method, or the first-in, first-out inventory management technique, tracks the value of goods as they enter and exit the inventory.

Debits and Credits Explained…But First, Accounts

Today, most bookkeepers and business owners use accounting software to record debits and credits. However, back when people kept their accounting records in paper ledgers, they would write out transactions, always placing debits on the left and credits on the right. An asset is physical or non-physical property that adds value to your business.

Debits and Credits Cheat Sheet: A Handy Beginner’s Guide

Later, he chooses to buy another 50 silver necklaces, but this time, the price has gone up to $30 per item. When it comes to deciding whether to credit or debit your inventory, there are pros and cons for both options. Drawings represent withdrawals made by the owner from the business for personal use.

The main advantage of inventory accounting is to have an accurate representation of the company’s financial health. However, there are some additional advantages to keeping track of the value of items through their respective production stages. Namely, inventory accounting allows businesses to assess where they may be able to increase profit margins on a product at a particular place in that product’s cycle. The main differences between debit and credit accounting are their purpose and placement. Debits increase asset and expense accounts while decreasing liability, revenue, and equity accounts.

For more information on how Sage uses and looks after your personal data and the data protection rights you have, please read our Privacy Policy. Expenses are costs incurred in generating inventory debit or credit revenue, such as rent or salaries. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

Credits boost your revenue accounts since they represent income your business has earned. For example, when a customer makes a purchase, you credit your revenue account, which increases your total income. As you process more accounting transactions, you’ll become more familiar with this process. Take a look at this comprehensive chart of accounts that explains how other transactions affect debits and credits. The owner’s equity and shareholders’ equity accounts are the common interest in your business, represented by common stock, additional paid-in capital, and retained earnings.

For instance, when your company keeps profits instead of paying them out, or when you or an investor puts in more capital, you credit the equity account to reflect the growth in ownership. For example, when paying rent for your firm’s office each month, you would enter a credit in your liability account. To help you better understand these bookkeeping basics, we’ll cover in-depth explanations of debits and credits and help you learn how to use both.

As you know by now, debits and credits impact each type of account differently. Conducting an accurate physical inventory is a vital component to creating an accurate, consolidated balance sheet at the university level. The physical inventory results directly impact the unit’s cost of goods sold, revenue, and profit, and ultimately, the information presented on the university’s financial statements. There’s a lot to get to grips with when it comes to debits and credits in accounting.

When you need to post a new entry, decide if the transaction impacts cash. Asset accounts, including cash, accounts receivable, and inventory, are increased with a debit. Expense accounts are also debited when the account must be increased. Review activity in the accounts that will be impacted by the transaction, and you’ll usually be able to determine which accounts should be debited and credited.